About Truv

Truv is a leading player in the open finance landscape, with a mission to empower consumers by giving them control over their financial data. This article explores Truv’s offerings, their impact on the financial industry, and their distinct approach to data management.

Exploring Truv’s Core Offerings

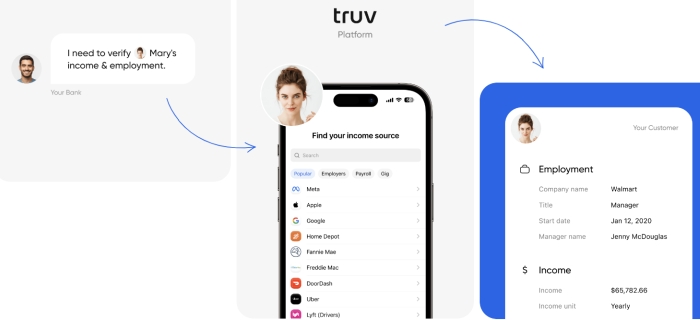

Truv’s platform offers a range of services focused on verifying financial data, including income, employment history, and insurance. These services play a vital role in a range of financial processes such as mortgage applications, lending, and tenant screening. Truv’s technology allows for efficient and precise verification processes at a reasonable cost. Here are the products:

Income and Employment Verification: Our service aims to streamline decision-making by offering trustworthy data.

Employment History Verification: This service is designed to enhance efficiency in employment-related verifications by providing a quick turnaround time.

- This service is designed to automate and speed up the insurance verification process, specifically for the mortgage and auto loan sectors.

- These groundbreaking products cater to both banking and lending sectors, enhancing customer engagement and reducing lending risks.

The Technology Behind Truv

Truv’s advanced technology platform is at the core of its operation. This platform comprises essential components such as the Truv Bridge, Dashboard, Orders system, and integrations with various financial institutions and data sources. These technologies enhance the user experience, provide personalized options, and effectively handle large amounts of data. The platform’s API-centric approach enables smooth integration with clients’ existing systems, enhancing the flexibility and scalability of its services.

Truv’s Mission and Impact

Truv aims to completely transform the landscape of financial decision-making, by prioritizing a holistic view of individuals’ financial situations rather than relying solely on conventional credit scores. This approach is especially advantageous for individuals who might face challenges with the traditional credit scoring system. Truv strives to empower a broader demographic by utilizing consumer-permissioned data, with the goal of promoting financial inclusivity and equality. Their approach aims to tackle the inaccuracies and exclusions commonly found in traditional income and employment verification methods.

Extensive Coverage and Wide Market Reach

Truv’s coverage is extensive, encompassing around 145.6 million Americans, which equates to roughly 92% of the labor force. This extensive coverage is made possible by integrating with more than 12,800 distinct payroll providers, employers, and gig platforms. The platform’s seamless integration with a wide range of single sign-on providers and its tailored solutions for enterprise integrations enhance its accessibility and usability across diverse sectors.

The Future of Open Finance with Truv

Truv’s journey is constantly evolving, with ongoing improvements to its platform and expansions into new areas of data, such as tax data, transaction data, and insurance data. The company’s dedication to innovation and customer-centric solutions positions it as a major influencer in shaping the future of open finance.

Kirill Klokov (Co-Founder & CEO) and Ilya Chatsviorkin (Co-Founder & CTO), Truv

In summary

Truv’s unique method of verifying financial data represents a notable advancement towards a more inclusive and precise financial ecosystem. Truv is revolutionizing the financial landscape by providing consumers and businesses with secure and authorized financial data, leading to streamlined processes and a more equitable financial system. Given the ever-changing landscape of the financial industry, Truv’s contribution in advocating for transparency and equality is becoming more and more crucial.