Mumbai, 23, December 2023

Aditya Birla Health Insurance Launches Activ One NXT Plan

Aditya Birla Health Insurance has recently unveiled its latest offering, the Activ One NXT Health Insurance Plan, marking a significant step forward in comprehensive health coverage. This new plan is designed to cater to the evolving health insurance needs of individuals and families, offering an array of features and benefits that align with contemporary health challenges.

Warning- Read disclaimer in the footer of this article.

Tabular summary of the key features of the Aditya Birla Activ One NXT Health Insurance Plan:

| Feature | Description |

|---|---|

| Up to 100% HealthReturns™ | Earn up to 100% of your premium back by staying active, such as walking 10,000 steps or burning 300 calories daily. |

| Super Reload | Provides 2X Sum Insured from Day 1 and unlimited times refill up to 100% of base Sum Insured from the 2nd claim in a policy year. |

| No Capping on Hospitalization Expenses | Covers room rent, ICU charges, modern treatments, HIV/AIDS cover, mental illness cover, obesity treatment, organ donor expenses, domiciliary hospitalization, home health care, AYUSH treatment, road ambulance cover, etc., as per actuals up to base sum insured. |

| Mental Illness Hospitalization | Covers hospitalization as well as pre- and post-hospitalization expenses for mental illnesses up to Base Sum Insured. |

| Super Credit (Optional) | Enhances coverage by adding 100% of SI per year, up to 500% of Base Sum Insured, up to a maximum of 3 crores, irrespective of claims upon policy renewal. |

| Claim Protect – Non-Medical Expense Waiver (Optional) | Covers all Non-Medical Expenses listed in Annexure 1 during hospital stay. |

| Home Health Care Expenses | Offers home healthcare treatment for any illness/injury up to the Sum Insured on a cashless basis through provider network/empaneled service providers. |

| Annual Health Check-up Program (Optional) | Provides preventive listed health check-up, once per policy year for insured persons aged 18 years and above on a cashless basis. |

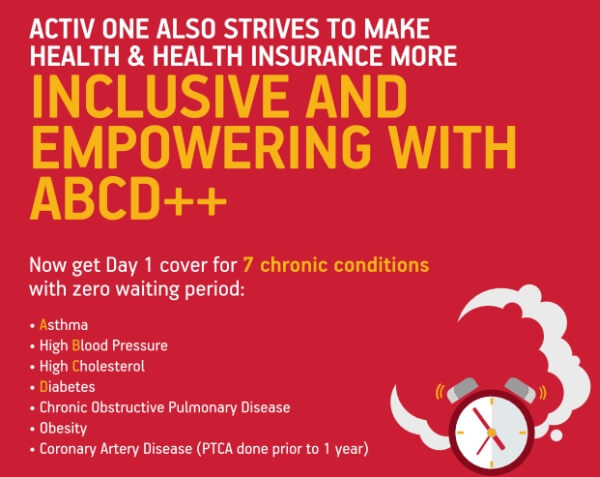

| Chronic Care – Day 1 In-Patient Hospitalization (Optional) | Covers Day 1 In-Patient Hospitalization for listed chronic conditions such as asthma, hypertension, hyperlipidemia, diabetes mellitus, COPD, obesity, coronary artery disease. |

| Chronic Care Management Program (OPD) (Optional) | Access to a fixed number of medical practitioner consultations and diagnostic tests for lifestyle conditions. |

| Personal Accident Cover (Optional) | Covers accidental death, permanent total disablement, and permanent partial disablement as per the Sum Insured. |

| Critical Illness Cover (Optional) | Covers up to 20 listed critical illnesses with a short survival period of 15 days after diagnosis and an initial waiting period of 60 days. |

| Cancer Booster (Optional) | Additional coverage for ‘Cancer of Specified Severity’ claims during hospitalization, including pre and post-hospitalization expenses, and Day Care Treatment expenses up to the sum insured. |

| Durable Equipment Cover (Optional) | Coverage for listed items such as wheelchairs and ventilators prescribed by a healthcare professional, up to INR 5 lacs or Base Sum Insured. |

| Compassionate Visit (Optional) | Covers the cost of a two-way economy class air ticket or travel fare up to INR 50,000 for hospitalization exceeding 10 days at a non-home location. |

| Second Medical Opinion for Major Illness (Optional) | Benefit of seeking a second medical opinion for listed 27 major illnesses through network hospitals. |

| Annual Screening Package for Cancer Diagnosed Patients (Optional) | Reimbursement for an annual screening package for insured persons diagnosed with cancer, subject to certain conditions. |

This table summarizes the major features of the Activ One NXT Plan, highlighting its comprehensive coverage and optional benefits. For more detailed information, including specific terms and conditions, it’s advisable to refer to the policy documents or consult with an insurance advisor.

1. Comprehensive Coverage:

The Activ One NXT Plan promises extensive coverage options that cater to a range of medical needs. From hospitalization expenses to day-care procedures, the plan is structured to alleviate financial burdens during medical emergencies.

2. Flexibility and Customization:

Recognizing the unique needs of each individual, the Activ One NXT Plan offers flexibility in choosing sum insured options and policy terms. This customization ensures that policyholders can tailor their coverage to match their specific health requirements and financial capacity.

3. Wellness Incentives:

In line with Aditya Birla Health Insurance’s commitment to promoting wellness, the Activ One NXT Plan incorporates incentives for maintaining a healthy lifestyle. These incentives not only encourage policyholders to adopt healthier habits but also potentially reduce their premium outlays.

4. Additional Benefits:

While the brochure details specific additional benefits, typically, plans like these offer value-added services such as health check-ups, teleconsultations, and health coaching. These features emphasize preventive care and overall well-being.

Summary:

The launch of the Activ One NXT Health Insurance Plan by Aditya Birla Health Insurance is poised to redefine the health insurance landscape. By offering a blend of comprehensive coverage, customization, wellness incentives, and additional benefits, the plan stands out as a robust solution for individuals and families seeking reliable and holistic health insurance coverage.

Disclaimer – Think, Learn and Invest

Paid Financial Consulting to choose right insurance and mutual fund